[ad_1]

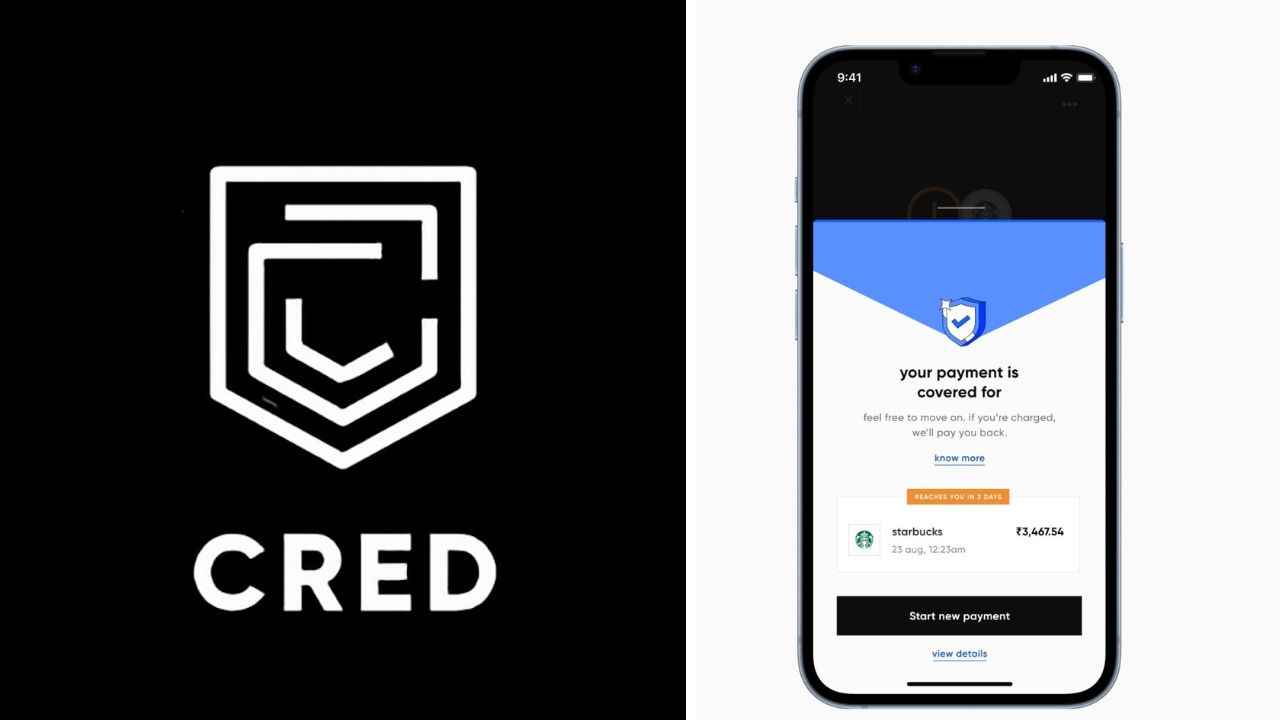

Bank card invoice cost platform Cred on Saturday launched ‘Scan & pay’, a UPI cost expertise for members on the app.

The members could make UPI funds from their financial institution accounts linked to the CRED app, by scanning any QR code.

“The all-new Cred pay expertise builds on prime of this with privacy-first options, personalisation and different member exclusives,” stated Kunal Shah, Founder, Cred.

The corporate stated that each ‘Scan & Pay’ cost is protected and if the cost is caught and awaiting affirmation from the recipient’s financial institution, “Cred members can skip the nervousness and provoke one other transaction”.

Members might be assured that they are going to be credited a refund in circumstances the place a cost has been debited, not reached the recipient, and is later deemed profitable, stated the corporate.

This characteristic is out there as a CRED member privilege for funds made utilizing ‘Scan & Pay’.

The members utilizing ‘Scan & Pay’ can get 2 occasions rewards at associate retailers, offers on marquee manufacturers, cashbacks and curated experiences, the corporate knowledgeable.

Companion manufacturers providing curated rewards to Cred members utilizing ‘Scan & Pay’ vary from Starbuck, Consumers Cease, Puma, and Chaayos, amongst others.

“The nation’s prime 1 per cent have set the stage for the way India consumes and we consider they deserve an expertise that celebrates their contribution,” stated Shah.

[ad_2]

Source link