[ad_1]

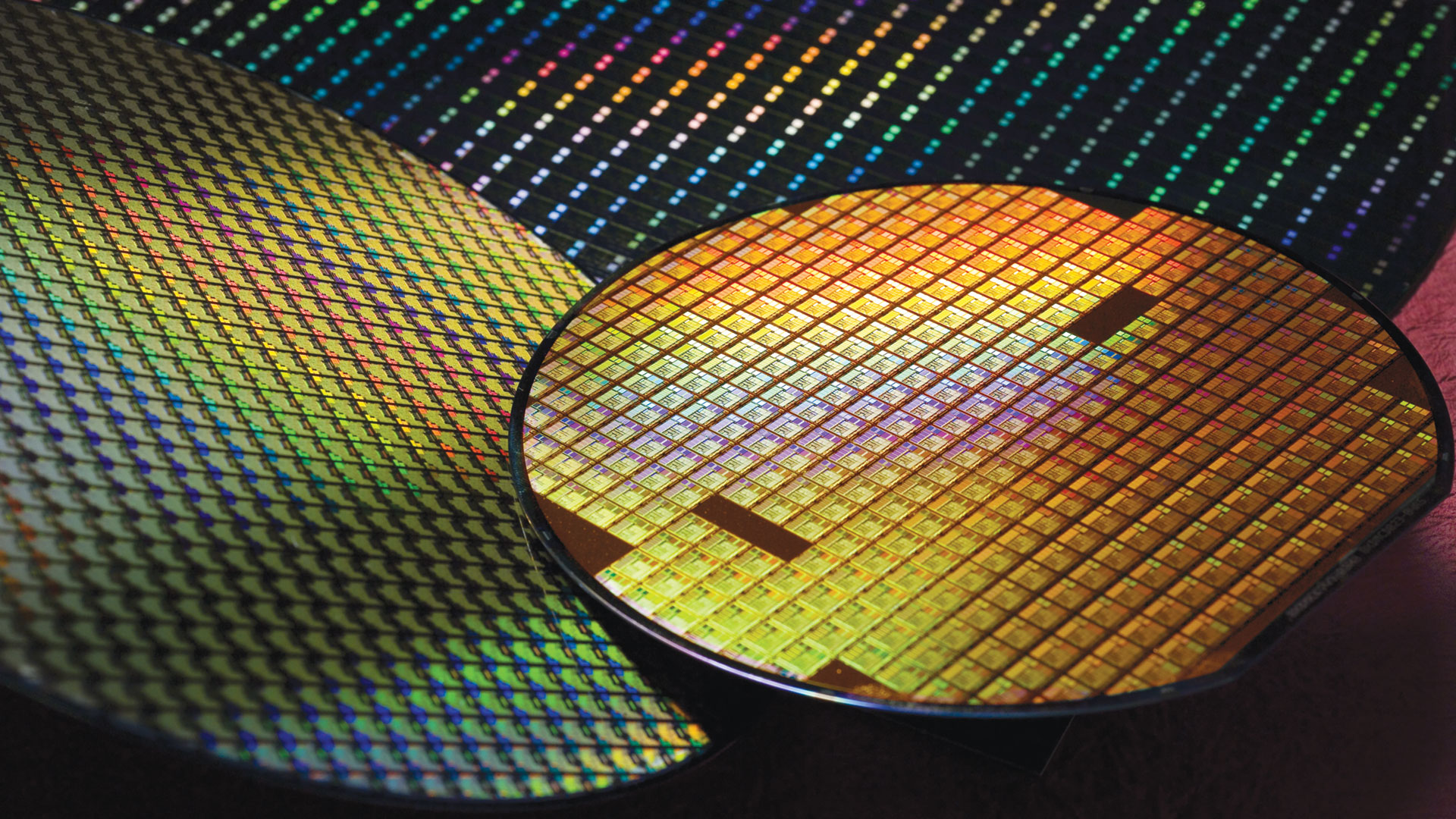

With regards to superior semiconductor expertise, there’s one title that sits above all: TSMC. However there are others in search of to problem the Taiwanese behemoth. Intel is spending billions as a way to declare a bigger slice of the chip making pie. GlobalFoundries and UMC are sometimes cited as rivals too. Then there’s Samsung, a reputation everybody is aware of.

Although it hasn’t been in a position to compete with TSMC on the bleeding fringe of semiconductor manufacturing in recent times, Samsung has made no secret of the truth that it desires to problem and surpass TSMC. Although Samsung and TSMC’s 3nm nodes will not be equal, the variations do not matter a lot if yields aren’t as much as par, and Samsung is reportedly doing effectively on that entrance.

In line with Korean-based newspaper Kukmin Ilbo (by way of @harukaze5719) Samsung’s 3nm yields are presently across the 60% mark, above the 55% degree of TSMC. In distinction, Samsung’s 4nm yield is 75%, whereas TSMC is at 80%. That is anticipated. As nodes mature, yields improve.

Recall that Nvidia’s RTX 30 Ampere GPUs have been made with Samsung’s 8nm node, whereas RTX 40 playing cards are made with a tweaked TSMC’s 4N node. Samsung wouldn’t have been completely happy to lose a buyer like Nvidia. If it is to win again large pocketed clients, it must compete with TSMC.

A aggressive Samsung is vital for players and customers basically. Presently, capability is proscribed and producers should compete for entry to essentially the most superior nodes. Which means firms with the most important pockets are in a position to lock up many of the obtainable capability. I am taking a look at you Apple. Throw a couple of billion round and see what it will get you.

In flip, the likes of AMD and Nvidia are compelled to pay extra per wafer or chip, and who bears the burden of these increased costs? You bought it: us.

The competitors for superior wafer begins is simply going to ramp up. The iPhone 15 is one factor, however then there’s the insatiable demand for AI chips. When you may have merchandise promoting for tens of 1000’s of {dollars} every taking precedence, these of us searching for an inexpensive RTX 4080, RX 7900 XT or some other GPU or CPU you care to call are left wanting and compelled to pay extra.

And that is why it is higher for us if Samsung’s nodes and yields are aggressive. After all, the price of wafers or usable chips would not immediately result in finish merchandise rising or falling in worth, however there may be correlation. If AMD, Nvidia or Intel actually need to achieve some gaming market share, they’re going to have some margin to play with.

On the GPU aspect, the dream is to have Nvidia RTX 50, AMD RX 8000 and Intel Arc A800 (or no matter they find yourself being referred to as) all aggressive on efficiency and manufacturing processes. If that occurs, perhaps we’ll see a correct worth struggle, with ever quicker and extra inexpensive merchandise for players.

The identical elementary factors apply to CPU manufacturing too. The transfer to chiplet or tile architectures is effectively underway, and a aggressive Samsung means TSMC should take care of the truth that it now not has a monopoly on essentially the most superior chip making capabilities.

Low cost chips for chump change? Nicely, not fairly, however we are able to dream. It begins with competitors for TSMC. Samsung by no means actually went anyplace, however all of us want it competing head-to-head with TSMC within the large leagues.

[ad_2]

Source link